Is the luxury market’s slowdown over?

According to a study by consulting firm Deloitte, despite the unstable economic environment, luxury goods giants have successfully pulled through a period of weak sales growth, during which the top industry players by and large managed to protect their margins. Deloitte’s Global Powers of Luxury Goods 2018 report shows in fact that the position of the luxury industry’s European leaders has strengthened, as the world's ten leading luxury corporations rallied after some huffing and puffing in the recent past.

“We have some evidence that 2016 [the financial year the report refers to] marked the end of the slowdown experienced by the industry’s top luxury brands,” wrote Deloitte, adding that “the top 10 luxury corporations (...) generated nearly half of the Top 100 ranking’s aggregate sales. The three groups at the top of the ranking, LVMH, Estée Lauder and Richemont, posted double-digit growth year-on-year for each of the last five years. Sales growth slowed down for the majority of corporations, partly due to the comparison with high growth rates boosted by exchange rate differentials, but also as a result of the tough economic environment and the weakness of consumer demand for luxury products.”

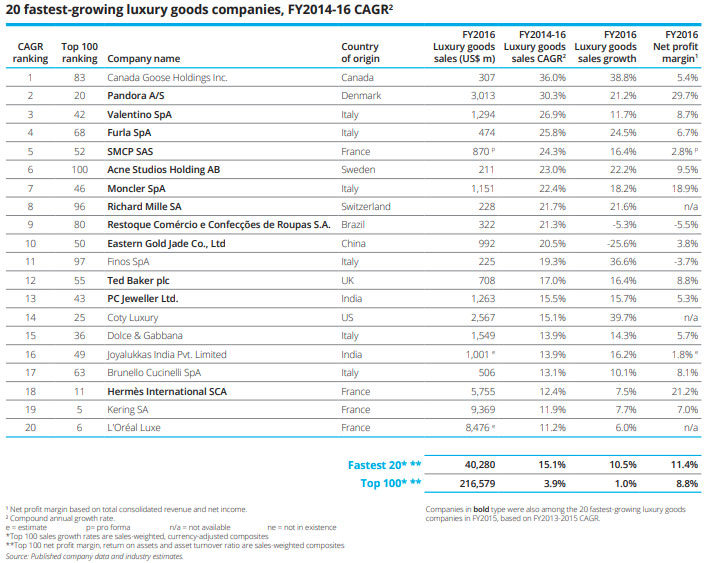

In the financial year 2016, the Top 100 luxury corporations are estimated to have generated a revenue of $217 billion in luxury goods, equivalent to only a 1% growth, compared to 5.8% the previous year at constant exchange rates. Nevertheless, 57 of the 100 groups ranked did increase their revenue, and 22 of them actually posted double-digit growth. Conversely, ten groups posted double-digit sales downturns in the year, among them two top-10 names, the Swatch Group and Ralph Lauren.

“However, the financial year 2016 seems to have marked a peak in the slowdown in the growth of luxury goods sales for the majority of corporations,” noted Deloitte, adding that “the initial aggregate figures for the 2017 financial year show improvements in performance.”

Above all, Deloitte observed that luxury groups’ margins have remained quite solid, and across the Top 100 they only detected a “mild dip.” For the eighty Top 100 groups which disclosed their margin percentage, on average there was only a 0.7% decline, the average margin being 8.8%. More than half of the groups reportedly improved their net income compared to the previous year. Of the 19 corporations generating a double-digit margin, nine were ranked in the Top 20. On the other hand, 11 corporations posted losses, compared to nine a year earlier.

“Only five groups recorded both double-digit growth in their luxury goods sales and a net profit margin in double figures, compared to eight last year,” wrote Deloitte. “Pandora and Moncler were the top performers: they recorded both double-digit growth and positive profit margins for all the financial years between 2014 and 2016. British fashion groups Burberry, Barbour and Kate Spade (before the latter’s acquisition by Coach), were the other big winners in the 2016 financial year.”

Copyright © 2024 FashionNetwork.com All rights reserved.